From 1 July 2021, a new law is to come into force, which will repeal the existing VAT exemption for shipments up to 22 euros. This law is valid for all states of the European Union. We are all used to buying smaller things in China (Aliexpress, Gearbest, Wish, Banggood, …) because we didn’t have to deal with VAT or customs duties. A big advantage is also subsidized postage, so we bought it cheaply and with free shipping. As a result, local vendors were disadvantaged and politicians had to intervene. The law aims to level competition between China and EU suppliers. We informed you about the planned change in the law in the article New Act from 2021 at the beginning of its planning in 2018. So what will it look like in practice?

Current vs new rules for shipments from outside the EU

Current situation

a) goods up to the amount of 22 euros – you do not have to worry about anything, the package will come to your mailbox

b) goods from 22 euros – 150 euros – you pay extra VAT = x% of (value of goods + postage + customs services)

c) goods over 150 euros – you pay an additional duty of 1-10% depending on the type of goods and you pay extra VAT. Customs duties are also included in the VAT calculation. For these shipments, expect a storage fee at the Czech Post is it 8 euro per shipment. It depends on the price list of your local post office or the DHL price list.

New from 1.7.2021

a) goods up to 150 euros – you pay extra VAT = x% of (value of goods + postage + customs services)

b) goods over 150 euros – you pay additional duties and VAT

You will find specific examples and how to proceed later in the article.

[su_note]

TIP FOR EASIER SHOPPING

If you don’t already use the Aliexpress Superstar browser add-on, be sure to add it. Not only does it show you the price history, search by image, different currencies and much more.

[/su_note]

Example of VAT calculation from 1.7.2021

The value of consignments is calculated from the price stated on the documents relating to the imported goods and it is clear from them who, for whom, for what, in what amount and currency and in what quantity (order, invoice, account statement or pay pal) .

Calculation of customs debt:

CLO = x% z (value of goods + postage)

VAT = x% z (value of goods + postage + customs)

We recommend ordering more goods in one package from the same seller, so that you do not have to pay customs declaration fees for each shipment. From 1.7.2021 it will be possible to handle the entire customs procedure electronically through the customs administration. Therefore, if you arrange everything electronically, you don`t have to pay the fee for representation by your local post office. (for example 9 euro in Slovakia).

Example of calculation:

This is an example, don’t forget to adjust the calculation according to your amount of VAT in your country and representation fees by your local post office.

A) You ordered goods worth 10 Euros and the shipping was free, you can handle the customs procedure electronically yourself (you will save 9 Euros for representation of your local post).

The VAT base is 10 Euros times 20% = 2 Euros. The total amount for the goods would be 10 Euros + 2 Euros = 12 Euros

B) You ordered goods worth 10 Euros, shipping was free, representation by post costs 9 Euros.

The VAT base is 10 Euros + 9 Euros = 19 Euros. VAT is calculated 19 Eur times 20% = 3.8 Eur. The total amount for the goods is 10 Euros + 9 Euros + 3.8 Euros = 22.8 Euros.

If you arrange everything yourself, you will save 22.8 Euros – 12 Euros = 10.8 Euros.

“Specific instructions on how to proceed will be published in advance” informs Hana Prudičová from the General Directorate of customs in Czech republic, stating that the customs declaration fee will not be charged, but the customer will still have to count on payment for storing the package in the so-called temporary warehouse of the transport company

[su_note]

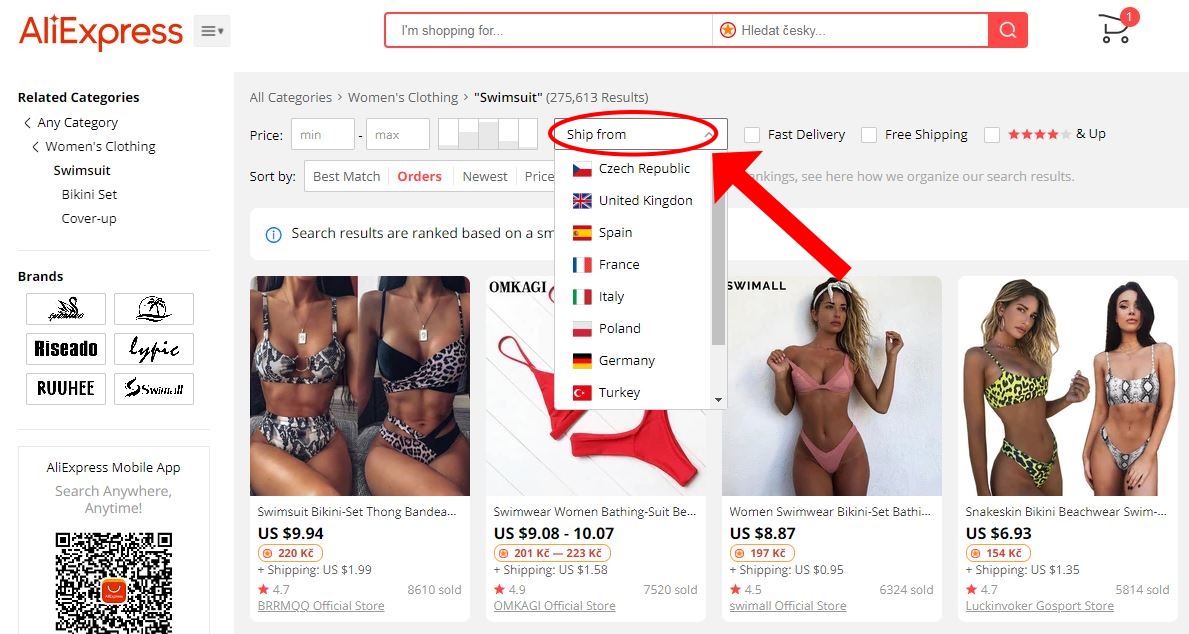

How to search European warehouse

Do you want to order products from European warehouse? Here is a new article how to find them on Aliexpress.

[/su_note]

And how will Alibaba react to that?

Alibaba is the operator of Aliexpress and certainly does not want to lose millions in sales to EU countries. Sellers at Aliexpress will be able to register in the European Economic Area. This would mean for us that we will pay the tax automatically when paying in the e-shop. The seller would reflect the amount of VAT in the price of the goods. The customer would then not be surprised by the surcharge when the shipment arrives in the country.

Another way to circumvent the new law is by European warehouses. Alibaba is building its own network of warehouses and even has a stone shop in Madrid. So, in the end, everything might not be as complicated as it may seem now.

You can already order from European warehouses. A great advantage of orders from European warehouses is the speed of delivery of goods. Aliexpress states delivery within 3-7 days, for example from France, Poland, Belgium, the Netherlands, etc. If you order goods from EU countries, you do not have to deal with any customs duties or VAT.

We have been ordering electronics from the Gearbest e-shop for several years. When ordering, we chose delivery from the European warehouse and we never had to deal with customs or VAT.

Statement by the Minister of Finance

“Companies from the Czech Republic and other European Union countries have to pay VAT as payers, no matter how much the goods sold. On the contrary, thanks to the VAT exemption, companies from third countries can afford to sell the same goods at a significantly lower price and have European great competitive advantage, “says Finance Minister Alena Schillerová.

In recent years, imports of consignments from third countries have increased significantly, especially from Asian countries. Up to 150 million small consignments excluding VAT are imported across the EU. “The current situation directly leads to a fictitious underestimation of the goods, so that their price does not exceed the limit of 22 euros and the shipment does not have to be taxed. The abolition of the exemption for small consignments from third countries will reduce the scope for VAT circumvention and help to combat cross-border tax evasion more effectively, “added the Minister of Finance of Czech Republic.

We will inform you

We will monitor the development of the situation and inform you in time. It does not matter when you ordered the goods, but the date of delivery to your country is important for the calculation of customs duties and VAT. So if you want to meet the deadline before 1.7. 2021 we recommend ordering as soon as possible.

And what about you? What is your opinion on the change in the law from 1.7.2021? Write us your opinions in the comments.