Aliexpress has finally announced how it will approach the new European Union VAT regulation for small consignments up to 22 EUR. So it will be, as we predicted in our article What should I do if the goods arrive after 1.7.2021? From 1 July 2021, VAT will be paid when paying an order directly on Aliexpress.

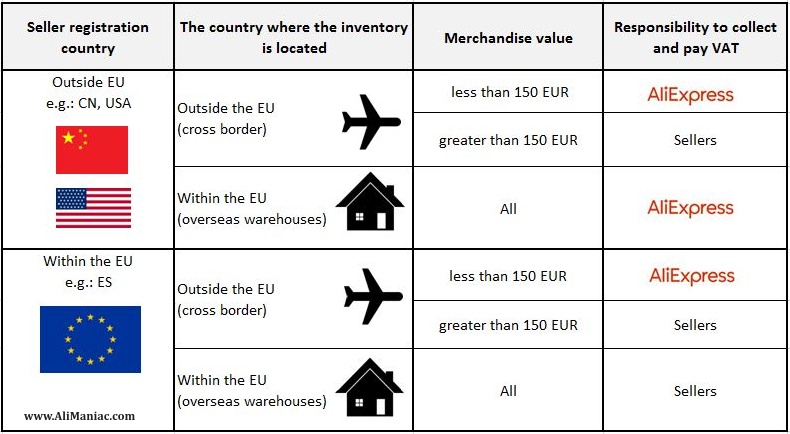

Aliexpress has already officially registered in the IOSS system, so we will not have to pay VAT separately and additionally. We have a clear table for you, according to which you will know when you have to settle VAT and customs duties yourself and when you only need to file a customs declaration.

NEW: Filter Aliexpress Standard or Saver Shipping. Read more information in article 60. How to filter products with Aliexpress Standard or Saver shipping on Aliexpress.

Why does the EU need VAT reform?

In order to create a level playin field for sellers from EU and outside EU, online and offline, the EU will apply new VAT rules to e-commerse sales. Which will affect goods imported to the EU across the 27-nation bloc. The new tax will come into force on July 1st.

What is VAT?

VAT is kind of tax on consumer spending that varies from country to country in the EU. Standard rates range from 17 % (Luxembourg) to 27 % (Hungary). The VAT rates of AliExpress is key EU countries can be referred to as follows: Spain (21%), France (20%), Poland (23%), Belgium (21%), Italy (22%), Germany (19%), Netherlands (21%).

Two major changes of EU tax reform

- Removing of Exemption for the Importation of goods valued at less than 22 euros

- AliExpress will calculate and pay VAT in some cases

Old vs new rules for shipments from outside the EU

To summarize, let’s recall what the limits of the amounts for the goods were and what they will be like. You can find more specific examples with calculations in the article What should I do if the goods arrive after 1.7.2021 ?.

As it was until June 30, 2021

a) goods up to the amount of 22 euros – you do not have to worry about anything, the package will come to your mailbox

b) goods from 22 euros – 150 euros – you pay extra VAT = x% of (value of goods + postage + customs services)

c) goods over 150 euros – you pay an additional duty of 1-10% depending on the type of goods and you pay extra VAT. Customs duties are also included in the VAT calculation. For these shipments, count on a fee for storage at the Post. It depends on the specific price list of your Post.

Situation since 1.7.2021

If the shipment arrives from a third country (China, USA, UK, …), you must fill out a customs declaration or be represented by a carrier, eg Czech Post. Representation by the carrier in customs proceedings is for a fee. It depends on the specific price list of your mail or delivery company.

a) for goods up to 150 euros – you pay extra VAT = x% z (value of goods + postage + customs services)

b) goods over 150 euros – you pay additional duty depending on the type of goods 1-10% and pay extra VAT. Customs duties are also included in the VAT calculation. For these shipments, count on a fee for storage at the Post. It depends on the specific price list of your Post.

Shopping on Aliexpress from 1.7.2021

The new rules will apply to all 27 Member States of the European Union. We just remind you that the United Kingdom is no longer a member of the EU.

- For goods with a value of less than 150 EUR, AliExpress will be responsible for collecting VAT from consumers in accordance with EU tax laws and for paying VAT to customs. This means that you pay VAT when you pay for the order directly in the Aliexpress shopping cart. All you have to do then is make a customs declaration, because the goods are sold in the IOSS “Import One Stop Shop” mode, which means “single administrative place for import”. We will describe more about IOSS below.

2. For goods with a value of more than EUR 150, the customs authorities at the place of importation shall collect VAT and customs duties. This means that you have to make the payment of VAT and customs yourself via application in your country, or you can be represented for a fee by a carrier such as the Post.

Where can I find how much VAT I will pay on Aliexpress?

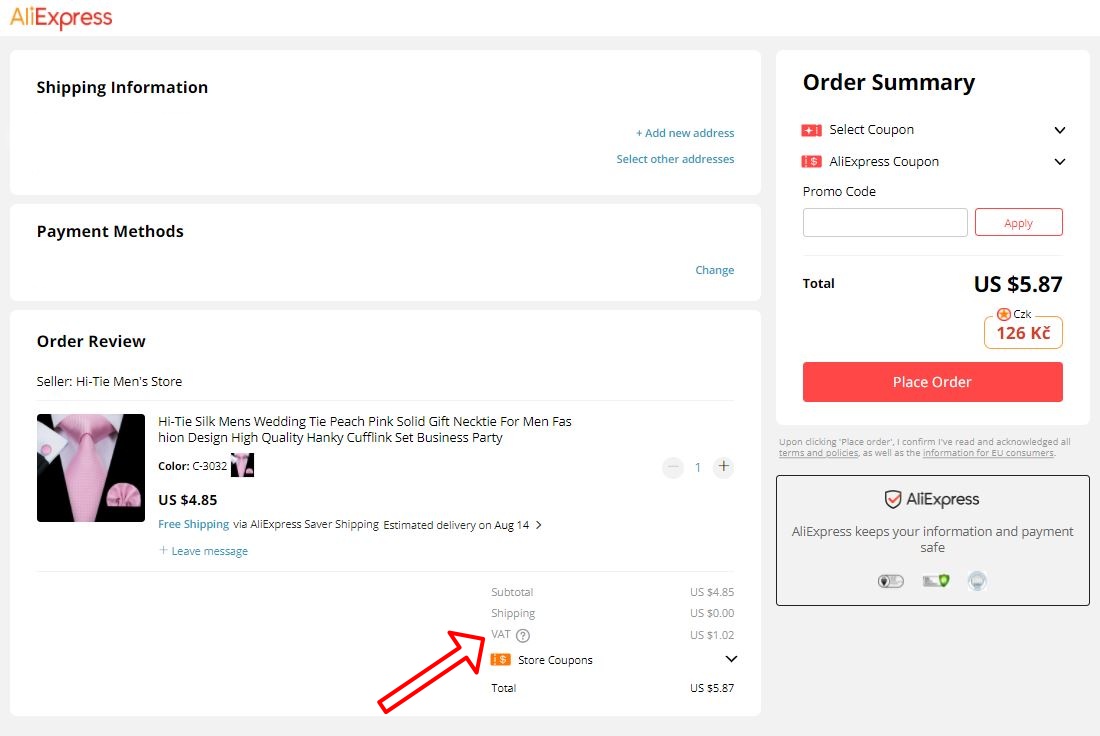

Add the selected goods to the cart and as soon as you pay for the order, you will see the price including VAT before payment. If you use the Aliexpress Superstar browser add-on, you will also see the total price converted to different currencies. Attention: if you set Czech crowns directly on Aliexpress, you will pay much more money for the goods. The sellers are increasing their postage there. Just install Aliexpress Superstar and you can see both prices, for example the price in dollars and the price in Czech crowns.

In the picture below you can see the price of the tie $ 4.85. You can see VAT (Value Added Tax) just under the shipping. VAT was calculated at $ 1.02. The total price for a tie is $ 5.87.

Aliexpress provides the following information for VAT: “From 1 July 2021, AliExpress generally will need to collect VAT on sales of goods delivered to EU consumers, including circumstances where goods are delivered from outside of the EU with order value of up to EUR 150, or where goods are shipped from within EU where the seller is established outside the EU. For more information, please refer to the Help Center.”

What is the Import One Stop Shop (IOSS)?

This is a completely new model of paying VAT on the import of goods into the European Union. This is only valid for shipments up to 150 EUR. VAT is paid when purchasing goods on the e-shop, as is now the case at Aliexpress. The e-shop then passes on the VAT paid to its representatives, who are specifically registered for VAT for this purpose in only one EU Member State. The representative then pays the VAT of the financial report of the state where this special registration is made. Therefore, this financial management is required as a single administrative point for the import of IOSS.

When ordering and paying for a shipment, do not forget to record the IOSS number. You will need it when completing the customs declaration. This number should be stated on the e-shop website or when viewing the order summary. If the value of the consignment does not exceed 22 EUR and the goods are purchased within one administrative place, then the IOSS number in the customs declaration is mandatory.

Try the Aliexpress Superstar browser add-on

If you are not using the Aliexpress Superstar browser add-on, we recommend that you try it. This tool is unique and will help you orient when shopping on Aliexpress. Thanks to it, you will find out, for example, the price history of each product, find out the rating of the seller from whom you buy the goods, search for any product on Aliexpress according to any image from the internet, all prices will be displayed converted into your currency. You will not pay anything for that. Everything is FREE. The add-on is already used by 30,000 users. Add it to your browser here too.

Our latest experience.

Goods shipped from AliExpress to Greece through an EEC’s member postal service,they are cleared through customs-VAT collected,and arrive in Greece with N O extra charges.

When goods are shipped through. a non EEC member nation,UZBEKISTAN recently,no connection between shipping company and Greece exists,resulting in payment of VAT for a second time.

I refer to my parcels UV539376025UZ and UV531406490UZ for which I am sked to pay again VAT.

What type of shipping did you choose when ordering? Did you choose Aliexpress standard shipping or other?